Four-year college campuses are filled to the brim every fall with new students, ready to bask in their new home away from home. Part of the “American Dream” is to pursue higher education and that path within young adulthood is encouraged now more than ever.

When my Nana was in highschool, back in the 1960’s, there was never a concrete expectation put upon her to achieve a college degree. My Nana talks now about how she is proud to see that all of her grandchildren are going on to college, but also how she is sort of remorseful with the fact that she didn’t and couldn’t experience it for herself, due to deciding to start a family.

Although I probably wouldn’t be here if she decided to continue her education, it’s still unfortunate that there weren’t many opportunities put in front of people, but women in particular, to become more knowledgeable about potential careers and ways they could live their lives that wasn’t motherhood or fit the box of societal norms back then.

In 1960, 7.7 percent of adults in the United States (25 and older) said they had graduated college. In 1960, from the ages of 25-29, there were about 11 million people, which means that there were only about 850,000 of the 11 million people alive in that age group that had graduated college. This culture has changed immensely since then. In 2022, 37.7 percent of adults in the United States (25 and older) said they graduated college. The difference between the same statistic in 1960 is an almost 400% increase.

There are definitely more people that go to college nowadays. There’s a ton of differences between the America we have now versus back then though. Our economy is more stable; people are presented with more opportunities; there are less deterrents to education towards minority groups in America; and higher education is now weighed heavily on professional endeavors.

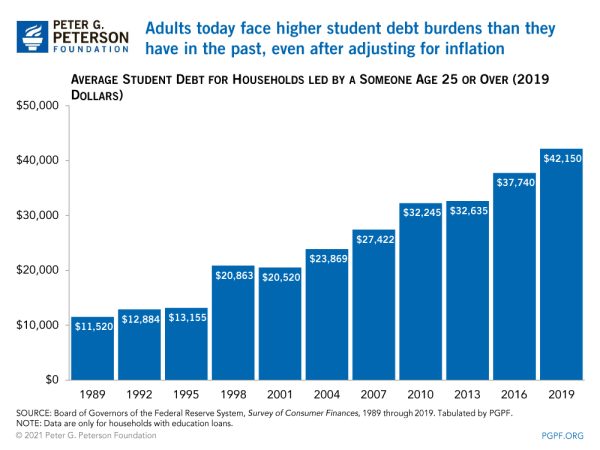

All of these have changed positively, but a shift that leaves 43.2 million Americans in debt today is the price of college. College education is a huge investment, not only because it gets more expensive as the level of prestige increases and the location in the country gets more preferable, but also because of the hidden burden of student loans. Ms. Denning, an English teacher here at Millbrook, speaks on what changes she believes need to happen in order to cut costs.

“A lot of changes need to happen with financial aid, and then with that too, a lot of changes need to happen at the university with loans, the fees that they have, and the student initial health insurance that you have to get if you don’t have your own. So I feel like these are bigger picture issues that are hard to tackle for just you and me,” she said.

Rising financial aid, student loans, housing costs, state funding, and sparse administration are all things that need to be addressed, but just like Ms. Denning admitted, they are problems that you and I can’t fix right in this moment. So, what can we do? Well, this is what Ms. Denning did.

“I came from a really poor county already, so a lot of us were getting good financial aid because our parents made little to nothing. With that, you still have to apply for a ton of scholarships. I basically had to be perfect throughout high school to even be considered for a scholarship,” Denning said. “I had to work a lot of jobs. I worked like three jobs in high school at a time and really that’s’ what helped, but everybody shouldn’t have to do that.”

Ms. Denning had to be a model student in high school and work her way through any funds she might have been lacking, but she ended up getting a full ride to N.C. State University. But when you don’t get a full ride anywhere, but are offered some form of financial aid, that tends to be the deciding factor to where you end up.

Millbrook senior Ketsia Madida spoke on her angle going into choosing colleges. “You have to think really intently about how much you were offered by the school financial aid wise. How much you have in scholarships and how much family contribution you have because if you’re lacking in how much the school is offering you financially, then that’s when you start to look into how much you need to take out in loans,” Madida said. “And if I know that I’m taking out more than I can pay back then one, ‘is it worth it?’ and two ‘Can I really see myself in the long run following through with that school?’ Personally, I haven’t taken out any loans, I know for grad school I will, but that’s something for the future. There’s a lot of things to take in with just one decision, you have to think about all the other aspects that surround it.”

Choosing colleges is not always about preferred location; the popularity of the college, if it’s an ivy or no, ; or what campus famous alumni attended. College seems like the first step into true responsibility and expectations because it’s bigger than a “dream” school.

It’s about choosing the best segway into your future. How much aid you can get offered from universities is a huge factor because you don’t want to take out loans that will eventually bite you in the behind, especially if you’re pursuing a career that doesn’t guarantee the payback to take care of those debts.. If you work hard though, and apply for scholarships diligently, there’s a good chance that you can be guided well into college and receive benefits that will help you reach heights you never thought you could.