America sets African-Americans up for failure

Wiping out discrimination is not an unreachable goal, but rather a goal which must be prioritized and worked toward. People of color are, in a sense, set up for failure in America, due to the white population’s nearly three century long head-start.

October 10, 2018

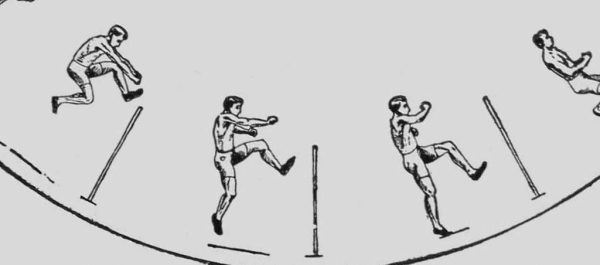

“If a man enters the starting line in a race 300 years after another man, the first would have to perform some incredible feat in order to catch up to his fellow runner.”

– Martin Luther King Jr.

Why We Can’t Wait (1964)

Like it or not, America was built on slavery – 246 years of slavery to be exact. In 1863 slavery was a three-billion dollar industry. So why, 153 years after the abolishment of slavery, is there still a distinct gap between the wealth of white and black Americans? The racial wealth gap is the difference in wealth between median households. The median white family’s household savings, plus assets, minus debt, equals $171,000; that of the median black family equals $17,600, and the gap continues to grow.

An important thing to note about wealth is it grows across generations, oftentimes in the form of investments. White America’s saving grace, compounding interest, allows value to increase more and more over time. The wealth of white college graduates increases dramatically over a lifetime, while the wealth of a black graduate’s decreases. This is largely because many black college grads are the most successful in their family network, so when they do accumulate wealth, they give a chunk back to their families. In contrast, many whites come from wealth; therefore, they can be greedy with their income. Consequently, the white population in America has consistently accumulated more and more wealth since the beginning of time. Meanwhile, African-Americans come from discrimination and prejudice, thus are subjected to unequal employment opportunity and pay; this makes it very difficult to catch-up to the white man.

Wealth is primarily shown through property, which blacks do not have equal access to. Big surprise. Historically, black families moving into predominantly white neighborhoods was a threat to property value. This is where the process of redlining gained its popularity. The Fair Housing Act drew maps to decide which neighborhoods to approve mortgages in, drawing red lines around black neighborhoods to deny financial aid. Modern day redlining is shown in the form of loan officers denying people of color conventional mortgage loans. Two-thirds of middle class wealth is in home ownership, and where you live affects numerous aspects of your personal life, such as where you go to school, where you work, your safety, your social network, etc. In addition to redlining, blockbusting is another discriminatory act commonly used in real-estate. Blockbusting is the act of showing black families around in predominantly white neighborhoods to prompt the current residents to quickly sell their properties at a cheap price. This allows the realtor to make a large profit by selling the houses for a higher price.

From 1990 to 2005 the homeownership gap beginan to close, but do not get too excited. The government was handing out Subprime loans like lollipops. Subprimes are for citizens with bad credit; they start very cheap but get much more expensive overtime. Banks were caught specifically targeting “African-American churches,” reeling them in with an enticing but deceptive deal. Just when a light appeared at the end of the tunnel, black communities lost 53% of their wealth.

The question remaining, how is it that white people so comfortably refer to black people as ‘ghetto’ when it is because of their racist views that black people are stuck in the ghetto? Senior Sean Prince commented, “I feel as if black people have to exceed the expectations of white America in order for us to be seen as intelligent.” At our society’s current status, it would take something truly radical to close the racial wealth gap. It begins with a change in government policy, which is still perpetuating racism in the twenty-first century, but must be conjoined with a change in attitude toward people of color.

Tahlieah Sampson • Oct 11, 2018 at 10:38 am

You’re gonna be a powerhouse! I can’t wait to see everything you accomplish

Morris Davis • Oct 10, 2018 at 11:04 am

Facts!! Well written!