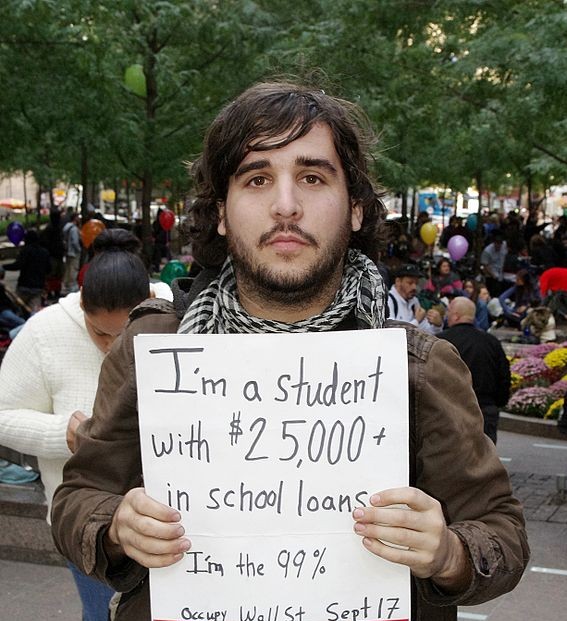

The student loan debt crisis

Protesting at an occupy Wall Street March, this man holds up a sign presenting his astronomical student loan debt. He is just one of millions.

March 29, 2017

College is quintessential to many students who wish to further their education. This past year, 65.9 percent of high school graduates enrolled in some type of college. College brings opportunities and jobs, as well as a steep price. According to the College Board, tuition for in-state public universities is $9,650 dollars and $24,930 for out of state students. When these numbers are multiplied by 4, in-state students spend approximately 38,600 dollars on tuition, while out of state students spend approximately 99,720 dollars. These numbers do not even include room and board or other necessary living expenses. These strikingly high numbers result in an immense amount of debt for students.

Since 2006, student loan debt has increased dramatically. In 2010, student loan debt exceeded credit card debt, and by 2016 student loan debt was at 1.4 trillion dollars. Approximately 43 million individuals have student loans and on average owe 30,000 dollars. All loans must be paid back over a specific time period. When senior Luke Gostling was presented with these numbers, he was appalled at how big of a problem student loan debt is: “I didn’t realize how many people have to go in debt to go to college.”

There are a large variety of student loans in the United States, but the most common form are federal and private loans. Federal loans are granted based off of individual’s financial needs, which is measured by the FAFSA application. There are two forms of government loans: subsidized and unsubsidized. Subsidized means that the government pays the interest on the loan while the student is in school. These are the preferred loans for students.

Private loans are seen as a last resort when students have exhausted the federal loan option. These loans are granted by banks or finance companies. Private loans tend to cost more and have less favorable rates, terms, and fees.

In light of these high costs, there are alternatives to consider, such as attending a community college. Prices at a community college fall well below a 4-year institution. By attending a community college, students can obtain an associate’s degree and continue onto a 4-year university if they wish to further their education. Another alternative is to apply for scholarships. A great resource for finding scholarships is on the college board website. The website has a search tool to help individuals find scholarships that they may qualify for. On average, each year 46 billion dollars in grants and scholarship money is awarded by the U.S. Department of Education and the nation’s colleges and universities. Additional savings can be earned by attending an in state public university rather than a out of state university or a private university.